How To Draw Peter Lynch Chart

The risks of buying and holding high PE shares and how y'all tin can calculate an entry toll

At that place are ii ways to make money from owning shares. The slow and steady way is to buy shares that pay good dividends, reinvest those dividends to buy more shares and then concur on to them for as long as you can (read my article on dividend investing).

The other way is to purchase a share and hope it goes up in price. This is known as investing for capital appreciation and is a strategy used by lots of investors. Many of us are looking for those shares that have the potential to make us multiples of the money that we invest in them. Peter Lynch, a famous American investor, used to wait for potential "ten-baggers" shares where the price could increase tenfold or even more.

Phil Oakley's debut book - out at present!

Phil shares his investment approach in his new book How to Selection Quality Shares. If you've enjoyed his weekly manufactures, newsletters and Pace-by-Step Guide to Stock Analysis, this book is for you.

Find out more

Share this article with your friends and colleagues:

Bones stock marketplace maths

However, it is useful to consider why shares get upward in price in the first place. This can happen when a company is taken over and is bought past another company. In most cases though, share prices ascent over time for two main reasons:

- Growth in a company's profits or earnings.

- An increase in the valuation the stock market puts on those profits - the valuation multiple - such as the price to earnings or PE ratio.

If you can purchase a share where both these events tin happen and then you lot could exist on to a winner. Let's say you buy a share in a company for 100p when its earnings per share (EPS) is 10p (the share has a toll to earnings or PE ratio of x times - 100/x). Over the next 5 years, the EPS doubles to 20p but the stock market place values the shares at xx times earnings (a PE of 20) or 400p each (20p ten PE of 20). You lot feel bully having made 4 times the money you invested in it.

If the shares had still traded at a PE of 10 times they would just take doubled in price to 200p (20p EPS ten PE of 10). In this case, the stock market has given you a helping hand by assigning a higher PE ratio to the shares. Nonetheless, what stock market place history tells usa is that it'due south a lot harder for shares on PEs of 20 to deliver big gains than it is for cheaper shares with lower Pes.

What it also tells us is that PE ratios can and exercise go down besides as upwardly. This is known as PE multiple compression and it tin have a devastating effect on the toll of shares with high PE ratios. Different dividends - which once paid cannot be taken abroad - share price gains can disappear very chop-chop in a conduct market and take years to get back, if at all.

That's non to say that buying and owning shares with high Pes cannot brand you lot money. They frequently do as long every bit their profits keep on growing strongly. But the high price - equally evidenced by the high PE - can make these shares very risky if profit growth slows or stops, or if the stock market enters a bear market and PE ratios in full general fall.

High PE stocks in the Britain marketplace

I'm not going to get into the nitty gritty of how PE ratios are determined in this commodity except to say that they are largely determined past the outlook for turn a profit growth, the riskiness of the shares concerned and the general level of interest rates (high interest rates tend to requite low PE ratios, low rates give high PE ratios).

What we accept seen since the stock market place bottomed dorsum in March 2009 is that many high quality companies with a expert track record of growing profits have seen the PE ratios on their shares keep to go upward.

But volition they continue to become up and will their profits proceed on growing? Perchance, maybe not. If you own a share with a high PE ratio, or are thinking of buying one, it is worthwhile taking the time to consider what has driven its share price over the last few years.

Has the share price inverse mainly because profits have inverse? Or is information technology considering of changes in the PE ratio?

This is important. If profits have been the main driver of the share price then that might mean the share is less risky if profits can go along on growing and the PE ratio isn't too high. If the bulk of the cost alter is due to a change in PE ratio and profits growth has been sluggish then the shares might be more than risky if profits commencement to refuse and PE ratios fall.

I've asked SharePad and ShareScope to discover shares in the FTSE 100 with loftier forecast PE ratios. What I've then done is look at what has happened to their share prices, EPS and PE ratios over the concluding vi years (since the stock market bottomed) and what EPS growth is expected in the future.

I've taken half dozen popular shares from the FTSE 100 and the information from SharePad is shown in the tabular array below.

Y'all tin can create the aforementioned tabular array in ShareScope.

Once you accept filtered the list of FTSE 100 shares, you can create a portfolio in SharePad/ShareScope and and then add results columns to the table. Don't worry about the corporeality of data fields I've included, hopefully you will meet why I've included them in a brusque while.

What you lot can see is that all half dozen shares take posted big gains in their share prices over the last six years and at present trade on high forecast PEs. By looking at the changes in their Foot and EPS you can brainstorm to understand what has caused their previous share cost rising which can help you make up one's mind whether to buy or sell a share or hold on to it.

Let's have a expect at what's been going on with these vi companies.

What if the PE ratios had remained the same?

I've used a spreadsheet to calculate some numbers but a pen and paper and a reckoner is all yous need.

I've taken the forecast EPS guess for each company from SharePad/ShareScope and multiplied information technology by the PE ratio of the shares 6 years ago to get the implied share price today if the PE ratio was unchanged. This gives the alter in the share cost due to changes in profits/EPS. So for Whitbread, its share price has increased by 2000p due to its profit growth.

| Fc EPS(p) | 6y ago PE | Implied Price(p) | Price 6y ago(p) | Modify(p) | |

|---|---|---|---|---|---|

| Associated British Foods | 102.two | 15 | one,533 | 638 | 895 |

| Whitbread | 199 | 14 | 2,786 | 786 | ii,000 |

| Reckitt Benckiser Group | 239.vi | 16.2 | 3,881 | 2517 | 1,365 |

| Burberry Group | 77.one | 16.6 | 1,280 | 276 | 1,004 |

| Unilever | 129.two | xiii | 1,680 | 1300 | 380 |

| Diageo | 92.7 | 15.vii | 1,455 | 766 | 689 |

Once you know the change in the share cost due to earnings growth, you take that number away from the total change in share price to give you the change which is explained by the PE ratio.

| Cost | Price 6y ago(p) | Change in cost | EPS growth | PE change | EPS % | PE% | |

|---|---|---|---|---|---|---|---|

| Associated British Foods | 2,849 | 638 | ii,211 | 895 | 1,316 | forty.50% | 59.l% |

| Whitbread | 5,235 | 786 | 4,449 | ii,000 | 2,449 | 45.00% | 55.00% |

| Reckitt Benckiser Group | v,862 | 2517 | 3,345 | 1,365 | one,980 | 40.80% | 59.20% |

| Burberry Group | 1,787 | 276 | ane,511 | 1,004 | 507 | 66.40% | 33.60% |

| Unilever | two,855 | 1300 | 1,555 | 380 | 1175 | 24.40% | 75.60% |

| Diageo | i,894 | 766 | ane,128 | 689 | 439 | 61.x% | 38.xc% |

So Whitbread's share cost gains tin can be explained 45% by its earnings growth and 55% by the increase in its PE ratio. For Unilever, just over 75% of its share toll increase is explained by a higher PE ratio. For Burberry, 66% of its gain is due to earnings growth.

What happens in the future is anyone'due south guess. Merely all these shares at present trade on what virtually people would acknowledge are loftier PE ratios. These PE ratios could keep on ascension merely they are unlikely to expand by as much in the adjacent half-dozen years as they have in the by 6 years. Therefore it may not be wise to count on the stock market giving these shares as big a boost in the time to come as information technology has in the past. The ability of these companies to grow their profits will exist much more important going forward.

Working out your risks

Investing is just every bit much virtually managing the risks you lot are taking with your money every bit it is nigh finding the side by side winning share for your portfolio. With high PE shares the risks tin be very high merely as I mentioned before there are 2 main ones that spring to mind:

- Can profits keep on growing?

- The chance of falling PE ratios

As far every bit future profit growth is concerned, we tin can use the analysts' estimates that are available in SharePad/ShareScope to see what is expected. I'll let you draw your ain conclusions every bit analysts forecasts aren't always worth a great bargain but only Unilever with expected EPS growth of xv% looks like growing strongly. Diageo'due south profits are expected to shrink by xx%.

What most the risk of falling PE ratios?

Information technology'due south fairly easy to work out what would happen if PE ratios started to decline.

If PE ratios were to return to 2009 levels and practical to forecast EPS and so these high PE shares could see their share prices fall significantly as shown in the tabular array below:

| Forecast EPS(p) | 6y ago PE | Unsaid Share price(p) | Current price | Departure | |

|---|---|---|---|---|---|

| Associated British Foods | 102.2 | fifteen | 1533 | ii,849 | -46.20% |

| Whitbread | 199 | xiv | 2786 | 5,235 | -46.80% |

| Reckitt Benckiser Grouping | 239.6 | 16.2 | 3881 | five,862 | -33.80% |

| Burberry Grouping | 77.1 | xvi.6 | 1280 | one,787 | -28.40% |

| Unilever | 129.2 | 13 | 1680 | 2,855 | -41.ten% |

| Diageo | 92.7 | fifteen.7 | 1455 | i,894 | -23.20% |

Alternatively, you could use the ten year average PE from SharePad/ShareScope to forecast EPS.

| Forecast EPS(p) | 10y avg PE | Unsaid Share toll(p) | Electric current cost(p) | Deviation | |

|---|---|---|---|---|---|

| Associated British Foods | 102.two | 17.iv | 1778 | 2,849 | -37.sixty% |

| Whitbread | 199 | 24.eight | 4935 | 5,235 | -5.70% |

| Reckitt Benckiser Group | 239.6 | 19.2 | 4600 | 5,862 | -21.50% |

| Burberry Grouping | 77.1 | 19.ane | 1473 | 1,787 | -17.60% |

| Unilever | 129.2 | 16.1 | 2080 | 2,855 | -27.10% |

| Diageo | 92.7 | 17.ii | 1594 | ane,894 | -15.80% |

Here, the predicted downside is less.

As always, do your ain research when looking at potential shares to invest in. Beingness a good investor is a lot about thinking well-nigh risks and what might happen in the future and SharePad and ShareScope tin can assist you lot with this. Investors in some high PE shares may continue to practice well but by looking at what has explained a share cost in the past you lot tin can make more informed decisions before parting with your coin.

Possible shares to consider

Fugitive losses and thinking about risks is something that every investor should think about. Just what about using the kind of assay I've been talking about to endeavor and find shares that might have better prospects ' where the PE ratio and EPS could become up.

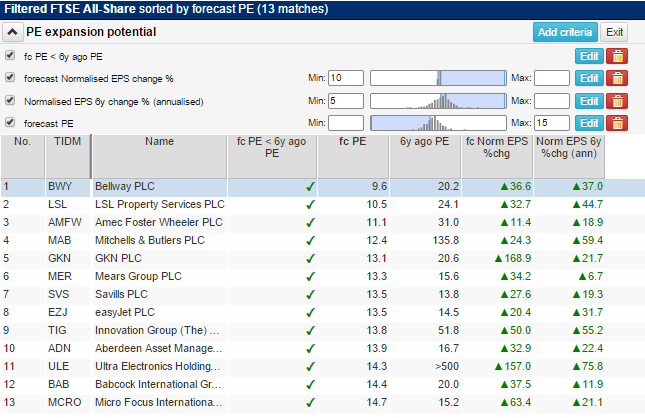

What you tin do in SharePad/ShareScope is look for shares where the forecast PE is less than the PE of vi years agone. In others words it looks as if the stock market doesn't like them every bit much as information technology used to but the market has gone upwardly a lot in the meantime. Perhaps these are shares that might have been left behind?

You can add whatever criteria you lot similar to your filter. This is what I've asked SharePad to look for:

- A forecast PE less than the PE of vi years ago.

- Annualised EPS growth of at least 5% during the last 6 years.

- A forecast PE of less than 15.

- Forecast EPS growth of at least 10%

The 13 shares listed are non shares you should go out and buy without doing more enquiry on. Hopefully though, you will see the immense flexibility that ShareScope and SharePad accept in helping you look for skilful investments.

Setting a target price based on PE ratios

You lot tin ask SharePad to summate a target toll for you based on the average PE over a menstruum of years or a PE upward to ten years agone. We've created a ShareScript for ShareScope Plus and Pro users to practise this also on the ShareScript Library - the script is titled Target price (PE).

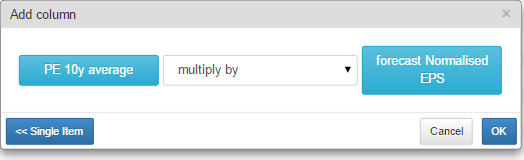

There'south a very handy feature in SharePad that allows you to create a cavalcade that combines data fields. This allows the users to configure nigh countless combinations of ratios and financial data to assist them answer lots of questions about a company and its valuation.

Taking the list of xiii companies above, I've asked SharePad to take the 10 year boilerplate PE ratio (where it can be calculated) and to multiply information technology by the forecast EPS. This will requite me a share price based on the 10 year boilerplate PE which can exist compared with the current share cost.

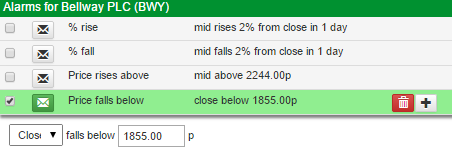

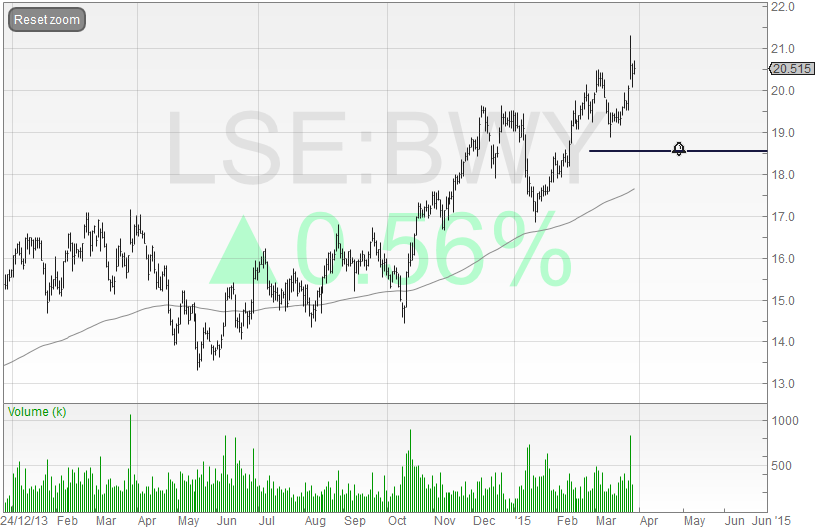

Allow'south say yous were interested in the shares of Bellway. Its shares are currently trading above its 10 year boilerplate PE, merely you lot can set up an alert in SharePad or ShareScope to tell you when the price falls below 1855p. SharePad will fifty-fifty send you an email when Bellway reaches the target toll.

For a more visual reminder, you lot can depict a line on Bellway's share cost chart at 1855p and set a line warning to tell you when the price has been reached.

If you have constitute this article of interest, please experience free to share information technology with your friends and colleagues:

We welcome suggestions for future manufactures - please email me at analysis@sharescope.co.uk. Yous can too follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Pace-by-Step Guide is published, send united states of america your email accost using the course at the top of the folio. You don't need to exist a subscriber.

This article is for educational purposes only. It is not a recommendation to purchase or sell shares or other investments. Do your own research before buying or selling any investment or seek professional person financial advice.

Source: https://www.sharescope.co.uk/philoakley_article7.jsp

0 Response to "How To Draw Peter Lynch Chart"

Post a Comment